From 1st March 2021 the VAT reverse charge comes into force in the UK for any VAT registered contractors and subcontractors operating under the CIS scheme.

If you are a VAT registered subcontractor operating under the CIS scheme, you need to assess your contractor/s by answering:

“Is the contractor I am Invoicing registered for VAT and currently operating the CIS scheme?”

If the answer to that question is no then the reverse charge rules do not apply and you simply need to carry on invoicing them in the same way you have been.

If the answer to that question is yes then you need to answer:

“Is the work I am carrying out zero rated or standard rated?”

If it is Zero rated work then the reverse charge rules do not apply and you will Invoice the contractor in the usual way.

If it is Standard rated then the reverse charge rules will apply and you need to follow the below steps when Invoicing the contractor

- When you raise your Invoice, you need to only charge the NET value of your materials and labour using ‘zero rated sales’ as a VAT rate.

It may be worth noting at this stage that the reverse charge scheme has no effect on you being able to reclaim the VAT back on your materials. All you’re doing is just not charging the VAT on to your contractor when you Invoice them.

- Make a note somewhere on the Invoice that the VAT reverse charge has been applied and also detail the amount of VAT that would have been charged if it were a standard rated sale. If you use online software, you will need to check to see if there is an option to activate the reverse charge scheme. If we bookkeep for you using Xero we will activate this function for you.

If your software doesn’t support this scheme, it might be that you look to set up a unique Invoice template to use for these specific Invoices so that the reverse charge notes and the Zero rated VAT rate are applied automatically.

If you don’t use software you will simply need to code the sales entry to a ‘zero rated’ vat code and make sure that you include the above notes on your Invoices raised.

Once you have assessed your contractors and determined if the reverse charge applies to any of them, you should send them an email to confirm that you will be invoicing them net of VAT and that the reverse charge will be applicable on your invoices.

You may find the following flowchart helpful in establishing when to charge VAT.

If you are a VAT registered contractor operating under the CIS scheme, you will need to look out for invoices from any VAT registered, CIS registered subcontractors with the reverse charge applied.

In the event of receiving such an invoice, you will be required to process it in your accounting records slightly differently, to apply the reverse charge on your VAT return.

-

- If you use accounting software, check to see if the reverse charge function is supported. If it is, activate the function.

Xero has released a function which you need to activate within the settings and QuickBooks have released a unique reverse charge VAT code. Sage also supports the function but it requires you to activate the CIS module in order to use it. If we bookkeep for you using Xero we will activate this function on your behalf.

- If you use accounting software, check to see if the reverse charge function is supported. If it is, activate the function.

- If you don’t use software or you use Sage and don’t want to use the CIS module, you will need to enter the invoice as per usual but apply a reverse charge VAT code. This will mean that the VAT element is entered into boxes 1 and 4 of your VAT return creating a net effect of Nil.

e.g. If an Invoice is for £50.00 net, the reverse charge VAT to record will be £10.00 (20% of the net).

The tax deducted from your sub-contractor payments is still calculated as 20% of the net labour charge. No adjustment needs to be made for VAT when making the payment.

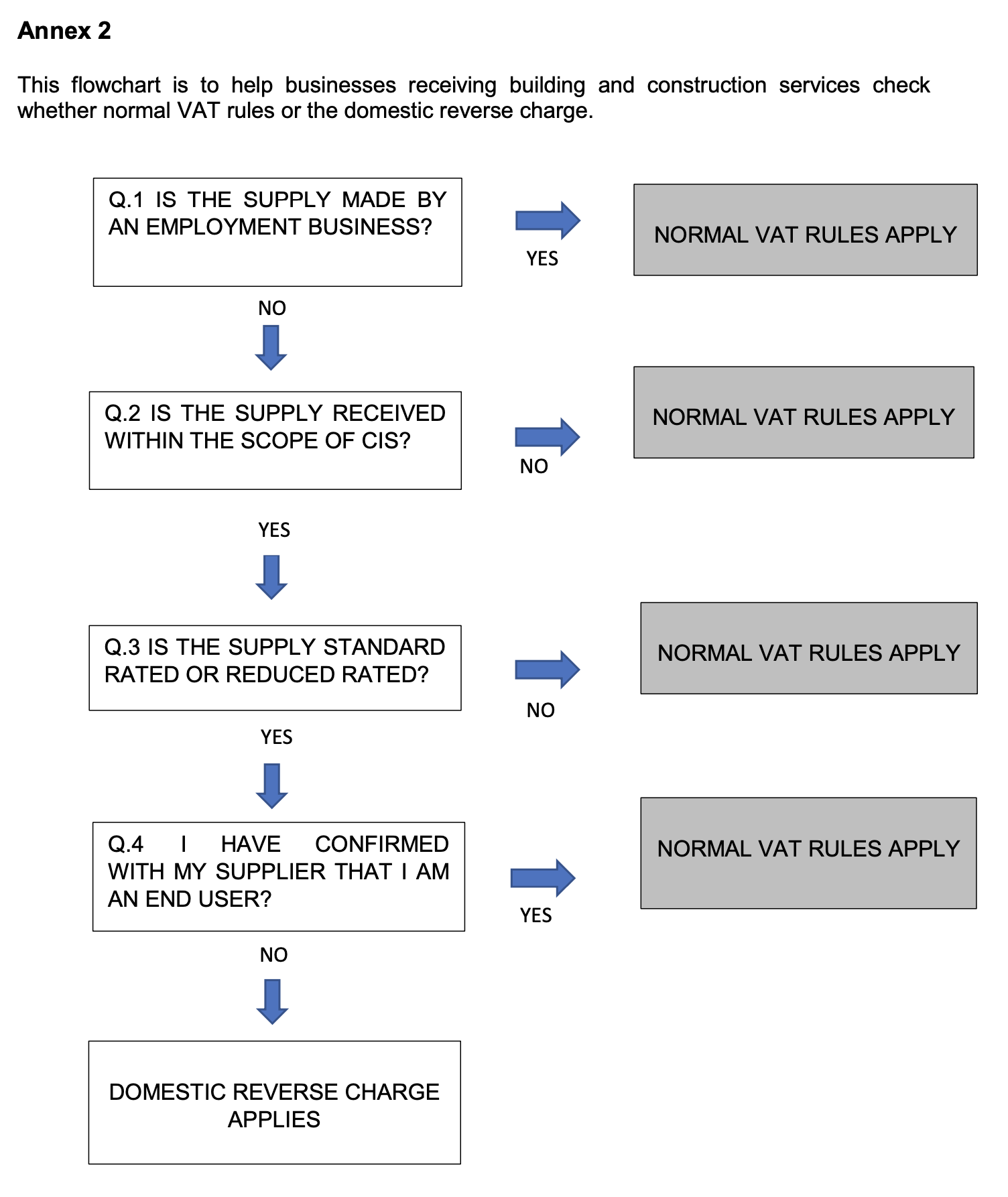

You may find the following flowchart helpful in dealing with the above.

1 Further information on ‘Employment Business’ can be found at Employment businesses and labour only sub-contractors.

2 If there is any uncertainty around the CIS treatment, you should contact the CIS Helpline on 0300 200 3210 (or +44 161 930 8706 if outside the UK).

3 If there is any uncertainty as to whether the reverse charge applies, you should contact the VAT Helpline on 0300 200 3700 (or +44 2920 501 261 if outside the UK).